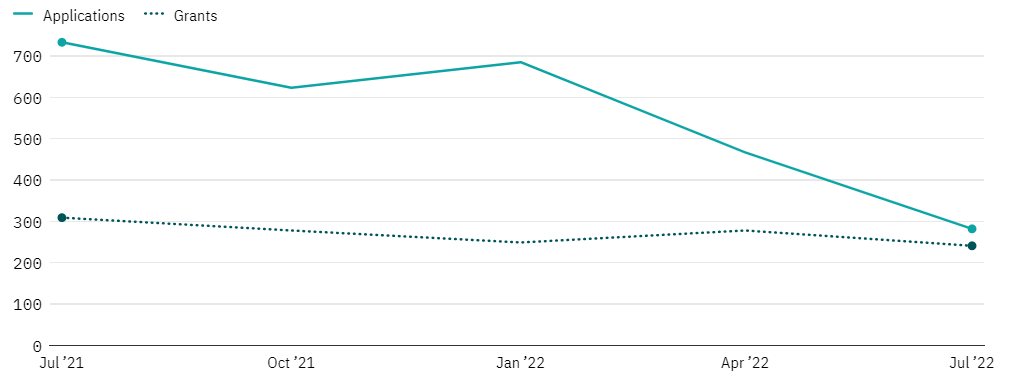

Research and innovation in fintech in the private banking sector has declined in the last year.

The most recent figures show that the number of startups related patent applications in the industry stood at 282 in the three months ending July – down from 733 over the same period in 2021.

Figures for patent grants related to fintech followed a similar pattern to filings – shrinking from 309 in the three months ending July 2021 to 241 in the same period in 2022.

Using textual analysis, as well as official patent classifications, these patents are grouped into key thematic areas, and linked to key companies across various industries.

Fintech is one of the key areas tracked by GlobalData. It has been identified as being a key disruptive force facing companies in the coming years, and is one of the areas that companies investing resources in now are expected to reap rewards from.

Fintech related innovation in the private banking industry has decreased in the last three months

Number of startups related patents and grants linked to private banking companies, by three-month period.

The figures also provide an insight into the largest innovators in the sector.

Ping An Insurance (Group) Company of China Ltd was the top fintech innovator in the private banking sector in the latest quarter. The company, which has its headquarters in China, filed 58 fintech related patents in the three months ending July. That was down from 61 over the same period in 2021.

It was followed by the Canada based The Toronto-Dominion Bank with 42 fintech patent applications, the United States based Bank of America Corp (29 applications), and the United States based JPMorgan Chase & Co (21 applications).

KB Financial Group Inc has recently ramped up R&D in fintech. It saw growth of 90.9% in related patent applications in the three months ending July compared to the same period in 2021 – the highest percentage growth out of all companies tracked with more than 10 quarterly patents in the private banking sector.