Description

The most widely used AML solution for monitoring unusual transactions, based on the FATF’s #1 recommendation: Risk-Based Approach.

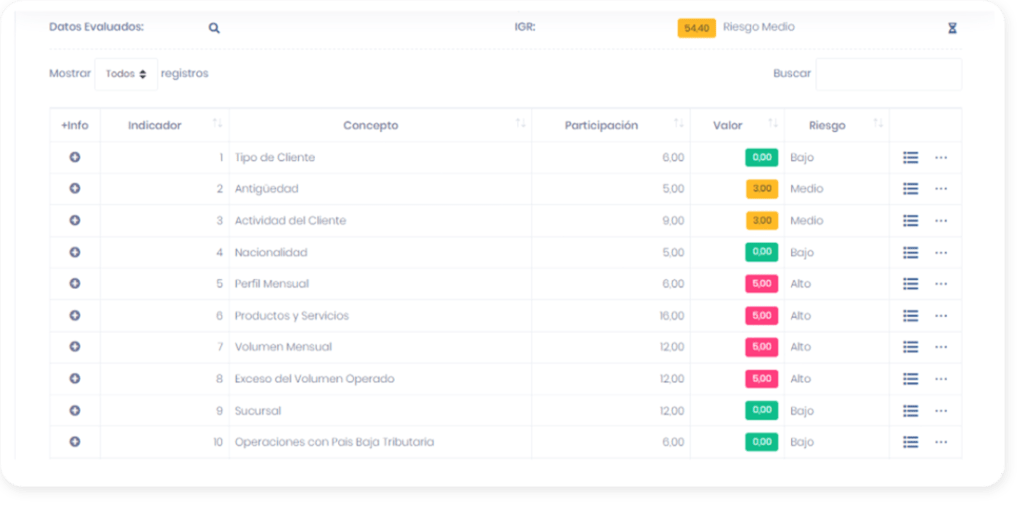

SOS – Transaction Monitoring is a RegTech solution to monitor suspicious transactions. A fully customizable platform that allows the organization to be aligned with the AML legislation of each country. Quickly detect unusual transactions based on alerts and risk matrices.

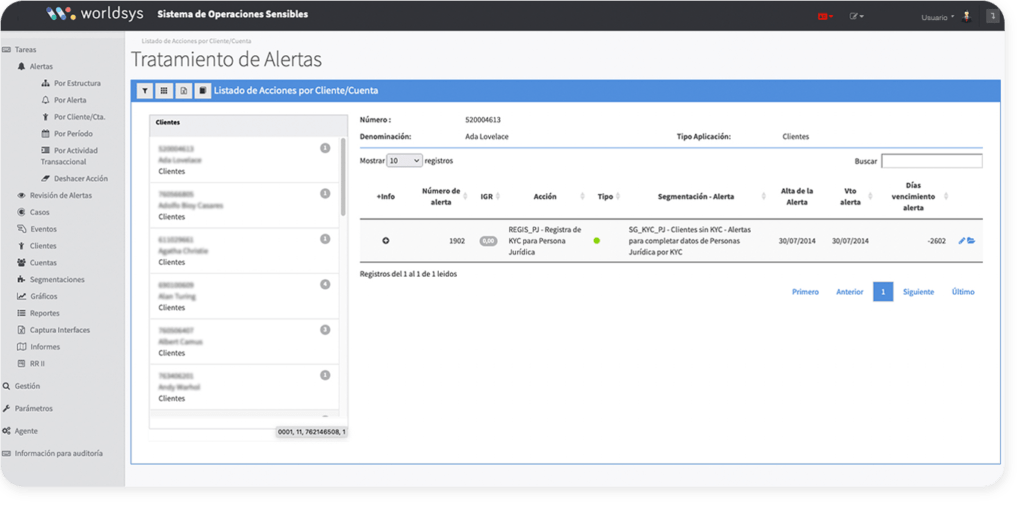

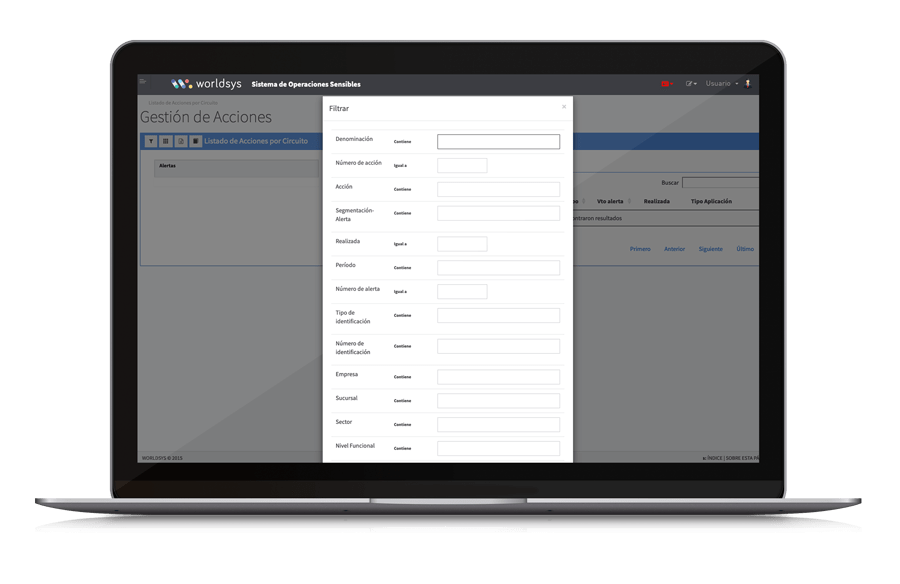

Automated alert processing

SOS has a set of default alerts according to international AML standards. The user can also configure their own alerts.

SOS allows to control the management of the users involved in the alerts. It has an automatic audit tool for pending events not fulfilled by the compliance responsible.

A fully adaptable compliance solution.

SOS is a fully customizable platform that allows the organization to be aligned with the legislation of each country. Quickly detect unusual and suspicious transactions based on transactional profiles according to standard rules and specific needs of each user.

SOS – Transaction Monitoring

The RegTech solution for most used by banks, financial entities, stock companies, mutuals and cooperatives, exchange houses, casinos, racetracks, other games of chance, security and cash transport companies, insurance, postal services, fintechs, automotive and dealerships, real estate and notaries, credit cards and payment systems.

Learning machine

- Automatically resolution with machine learning method.

- Knowledge base: Saves qualitative and quantitative information based on the registered courses of action.

- By predefined rules, it solves cases and generate the supporting documentation that details the decision-making process.

- Historical records of behaviors, actions carried out and results

Due diligence

- Performs automatically management of customer documentation.

- SOS automates the request for documents and manages the digital file, to comply with due diligence efficiently.

- The request and receipt of information can be done by email or by digital onboarding.

- Can be integrated with your organization's onboarding via Rest API.

Internal compliance audit

- Generate review alerts on the actions ejecuted by the compliance officer under multiple criteria.

- Audit process is efficiently managed and documentation is generated automatically.

API integration to Screening platform

- Connect SOS with Screening Lists, the most widely used PEP and sanction screening AML solution.

- Ensure compliance seamlessly with a complete AML suite. Both solutions can be connected via Rest API integration.