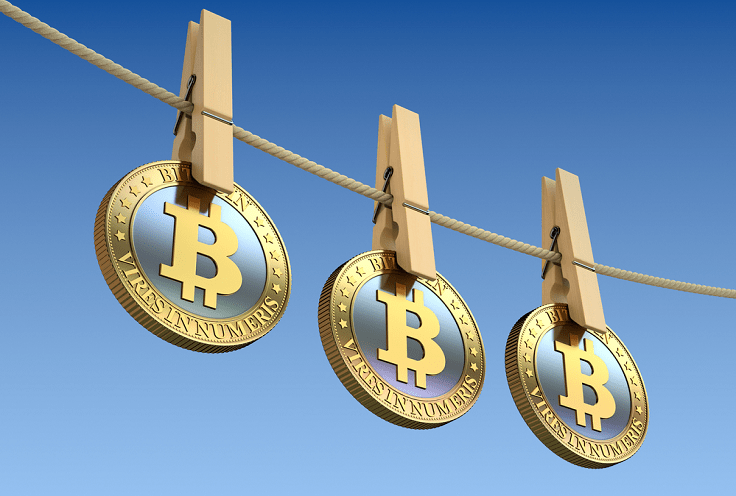

A 37-year-old Florida woman has been indicted in a cryptocurrency money laundering scheme in the Eastern District of Texas, announced U.S. Attorney Brit Featherston. Sharena Seay, of Jacksonville, FL, was named in an indictment returned by a federal grand jury, charging her with money laundering. She was arraigned in federal court by U.S. Magistrate Judge John D. Love. [Read more]